Does it seem like there’s never enough time in the workday to generate new leads or get started on the next big thing? Solve the problem by automating the monotonous office processes slowing you down.

Whether it’s extensive bookkeeping or spreadsheet generation, these manual labor tasks can be done more efficiently through the innovation that is automation. Below is a brief look into how automation can save money, increase production and reduce the time spent on paperwork in a financial office.

Aspects of financial operations to modernize could be accounts receivable (AR) and accounts payable (AP). Matters such as these require a great number of steps. From processing invoices and payments to setting up quotes and managing approvals, these practices and their associated workflows are notoriously time intensive.

Certain AR and AP automation software can handle all of the steps involved, freeing up employee time, diminishing errors and reducing fraud. What’s more, such programs can supplement accounting tasks with digital reminders, recurring invoices and automatic payment dates. The result is a more efficient workflow and potentially greater cash flow.

Another arduous responsibility that can be simplified through automation is claims processing. Employing cutting-edge technology, such as robotic process automation, can speed up the procedures while taking pressure off the claimant and the organization. One way this is achieved is by automatically extracting and transmitting data instead of having to search for it manually.

Put an end to tedious office chores that take focus away from your imperative, business-building tasks. Do so by investing in automation processes designed to save you time with administration, invoicing, report distribution and beyond.

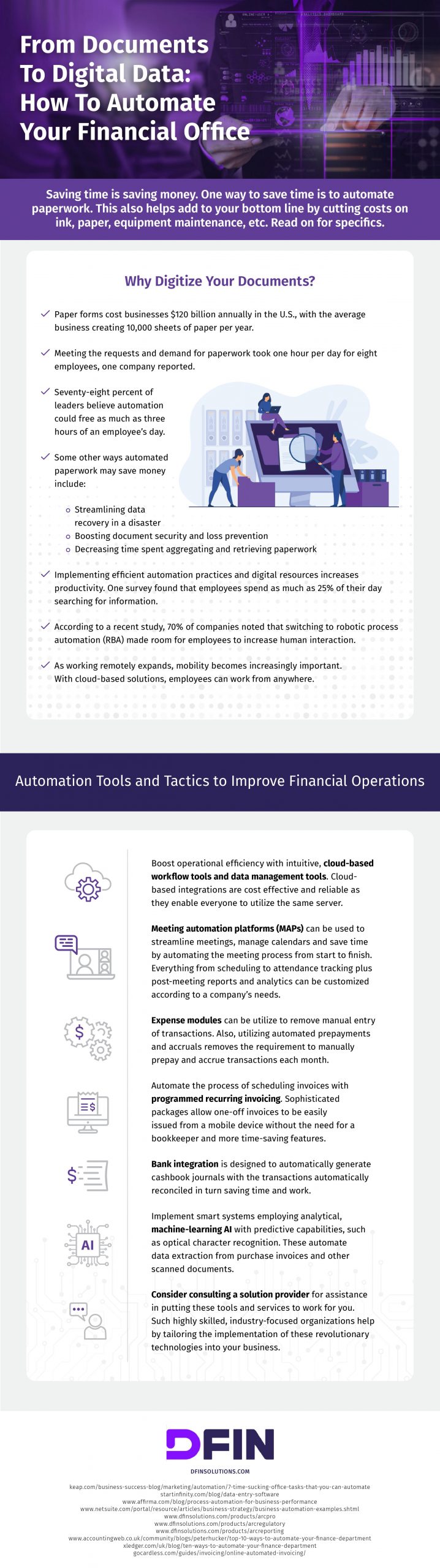

For additional examples of how to automate your operations, financial or otherwise, please see the accompanying resource.

IfrInfographic created by Donnelley Financial Solutions, a regulatory compliance software company